Tom Lee, co-founder and head of research at Fundstrat Global Advisors, has suggested that investors should seize the current opportunity to buy stocks, following the recent heated debate over the March CPI report that led to a market downturn.

Lee, one of the few bulls on Wall Street last year, accurately predicted that the S&P 500 index would surge by over 20% to 4750 points by the end of 2023. Indeed, the index’s unexpected rally last year fell just over thirty points short of his target. Among the strategists tracked by Bloomberg, Lee’s forecast was the closest to the mark.

The U.S. Department of Labor’s data released on Wednesday showed that the U.S. Consumer Price Index (CPI) rose by 3.5% year-on-year in March, reaching its highest level since September 2023, surpassing market expectations. Concurrently, this marked the third consecutive month of unexpectedly accelerated CPI growth in the United States. Many analysts believe that this has dashed hopes for a rate cut in the first half of the year.

However, Lee maintains that the possibility of a rate cut by the Federal Reserve in June still exists, despite futures markets indicating only a 20% probability following the CPI report.

“I don’t think this entirely rules out the possibility of a rate cut in June. Before the Fed makes its rate decision on June 12, it must digest three more CPI reports, and if any of these reports show a decline in inflation, the Fed may lean towards cutting rates,” he said.

Lee also pointed out that upon closer examination of the inflation report, it actually exceeded economists’ expectations only slightly, indicating sustained progress against inflation. Anti-inflation means lower rates of price growth rather than outright price declines. In his view, this suggests that the market downturn is another buying opportunity, much like after the CPI reports in December, January, and February last year.

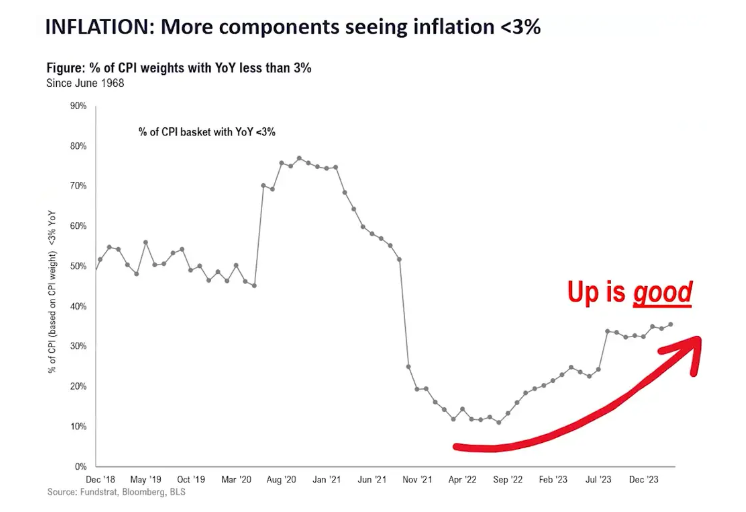

“Believe it or not, this is actually a very good CPI report. The chart below can explain this. I think this is why stocks sold off today will ultimately be bought back,” he said.

As shown in the chart below, it highlights that more fundamental components of the CPI report are beginning to see inflation return to long-term trend levels below 3%. “The forces of anti-inflation are very strong, and more things are closer to the trend,” he said.

Furthermore, Lee emphasized that the primary drivers of inflation in March were rising car insurance prices, which emerged after several years of soaring car prices during the pandemic.

“The increase in CPI data is almost entirely due to car insurance. So, it just tells you that it’s a timing issue, not a structural issue. In other words, there are no other factors driving CPI up,” he said.

Jeremy Siegel, finance professor at the Wharton School, echoed this sentiment in an interview on Thursday.

“Housing and car insurance are the two most lagging components of the Consumer Price Index. It has been confirmed that the increase in car insurance premiums will appear 12 to 15 months after the rise in used car and new car prices,” he explained, “Now, may be the best time to buy stocks!”